eth bridge crypto Unlocking Cross-Chain Opportunities

eth bridge crypto sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. Eth bridges serve as vital connectors in the ever-evolving world of cryptocurrency, allowing seamless transactions across different blockchains. By understanding their mechanics, benefits, and challenges, you can appreciate how they enhance liquidity and speed in the crypto ecosystem.

This fascinating technology enables users to transfer assets between Ethereum and other blockchains, bridging gaps that were previously seen as barriers. With a variety of protocols available, each with unique features and security measures, the potential of eth bridges is transforming decentralized finance and opening up new realms of opportunity.

Understanding Eth Bridges

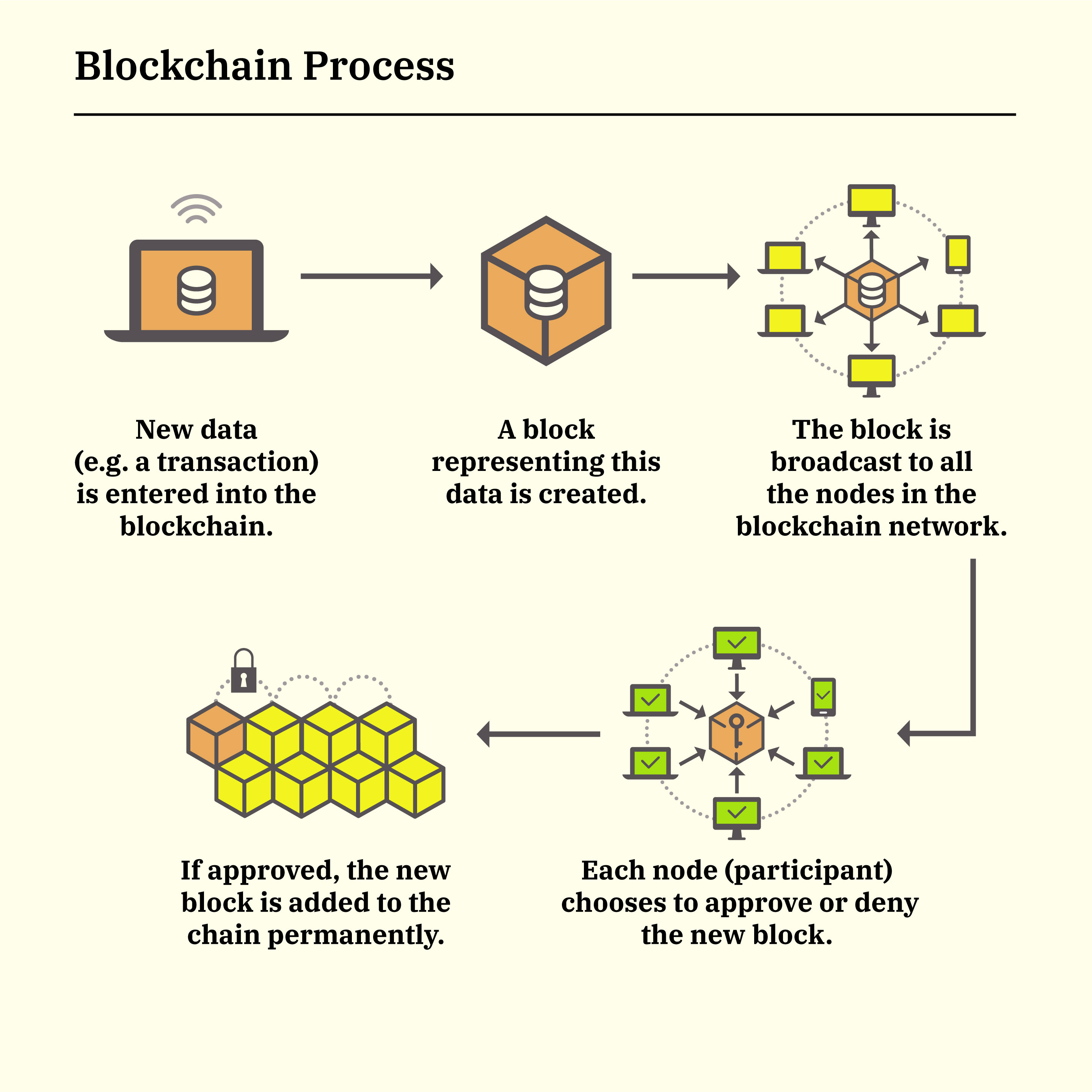

Eth bridges are innovative solutions that connect disparate blockchain networks, enabling seamless transfers of assets and information between them. In the rapidly evolving world of cryptocurrency, these bridges play a crucial role in enhancing interoperability and expanding the functionality of decentralized applications (dApps).The technology behind Eth bridges typically involves a set of smart contracts that facilitate the locking and minting of tokens.

When a user wants to move assets from one blockchain to another, the original tokens are locked in a smart contract on the source chain, and a corresponding equivalent is minted on the destination chain. This ensures that the total supply remains constant while allowing users to leverage the benefits of different networks. Unlike traditional blockchain transactions, which are often siloed and limited to their specific ecosystems, Eth bridges create a more fluid environment for asset movement and data exchange.

Benefits of Using Eth Bridges

Utilizing Eth bridges for cross-chain transactions comes with several advantages that are reshaping the cryptocurrency landscape.

- Enhanced Liquidity: Eth bridges facilitate a larger pool of assets that can be traded across networks, leading to increased liquidity in the crypto market.

- Improved Transaction Speed: Transactions executed via Eth bridges can often be completed faster than traditional blockchain transactions, which may be hindered by network congestion.

- Cost Efficiency: By allowing users to switch between blockchains, bridges can help reduce transaction fees by selecting the most cost-effective chains for specific operations.

Popular Eth Bridge Protocols

Several Eth bridge protocols have gained popularity due to their unique features and robust performance.

- Polygon Bridge: Known for its low fees and fast transaction times, it connects Ethereum with the Polygon network.

- Wormhole: This protocol enables cross-chain interactions between multiple blockchains, offering a versatile solution for users.

- AnySwap: A decentralized protocol that allows for the seamless swapping of tokens across various blockchain networks.

Successful cross-chain transactions have shown the effectiveness of these protocols. For instance, a user can transfer ETH from Ethereum to Binance Smart Chain using the AnySwap protocol, demonstrating the potential for decentralized finance (DeFi) applications.Security is a primary concern for users, and leading Eth bridge protocols implement robust measures such as multi-signature wallets and regular audits to protect against vulnerabilities.

Challenges and Risks Associated with Eth Bridges

While Eth bridges offer significant benefits, they also come with inherent challenges and risks.

- Security Risks: The complexity of smart contracts can introduce vulnerabilities, making bridges potential targets for hackers.

- Usability Issues: Some users may find the process of using Eth bridges confusing, particularly if they are not familiar with blockchain technology.

- Regulatory Concerns: As governments impose regulations on cryptocurrency, Eth bridges may face restrictions that impact their functionality and user accessibility.

Future of Eth Bridges in the Crypto Ecosystem

The evolution of Eth bridges is expected to continue, driven by advancements in technology and user demand.The next few years may see improvements in the underlying technology, making bridges more secure and user-friendly. For example, the integration of layer-2 solutions could enhance transaction speeds and reduce costs further. Eth bridges will likely play a pivotal role in promoting decentralized finance (DeFi) by enabling users to access a wider range of financial products and services across various platforms.

Practical Uses of Eth Bridges

Using an Eth bridge can be straightforward if users follow a few essential steps.

- Select the bridge protocol that suits your needs.

- Create a compatible wallet on the source blockchain.

- Initiate the transfer by locking your assets in the smart contract.

- Wait for the transaction confirmation and the creation of equivalent tokens on the target blockchain.

In real-world applications, Eth bridges have been utilized in various industries, including gaming, finance, and supply chain management, showcasing their versatility. Various assets, including ERC-20 tokens and NFTs, can be transferred using Eth bridges, fostering a vibrant ecosystem of cross-chain interactions.

Community and Resources for Eth Bridges

For those looking to delve deeper into Eth bridges, numerous resources are available for further learning.Community engagement is vital in the development and improvement of Eth bridges. Participating in forums and online platforms allows users to share experiences and insights, contributing to the collective knowledge base.Popular platforms include Reddit, GitHub, and various Telegram groups focused on blockchain technology and Eth bridges.

Engaging with these communities can provide valuable information and support for users navigating the complexities of cross-chain transactions.

Closing Notes

In conclusion, eth bridge crypto is not just a technical innovation; it is a movement towards a more interconnected and efficient financial landscape. As we look to the future, the potential for these bridges to evolve alongside technological advancements promises to reshape the crypto space, ultimately driving the growth of decentralized finance and enhancing user experience. Staying informed about these developments is key to navigating the dynamic world of cryptocurrencies.

Popular Questions

What is an eth bridge?

An eth bridge is a protocol that enables the transfer of assets between Ethereum and other blockchains, facilitating cross-chain transactions.

How do eth bridges improve transaction speed?

Eth bridges streamline cross-chain processes, reducing the time needed for transactions compared to traditional methods.

Are eth bridges secure?

While they incorporate various security measures, risks do exist, so users should conduct proper due diligence before using them.

Can I transfer any asset using an eth bridge?

Most bridges support a range of assets, but availability may vary depending on the specific protocol used.

How can I learn more about eth bridges?

There are numerous online resources, forums, and communities dedicated to discussing and educating users about eth bridges.

)

![Ethereum [ETH] – ConsenSys to Award $175K to 7 Ethereum Ecosystem ... Ethereum [ETH] – ConsenSys to Award $175K to 7 Ethereum Ecosystem ...](https://crypto-economy.com/wp-content/uploads/2023/12/Ethereum-Price-Analysis-1024x576.jpg)

/GettyImages-653398348-80c26f01cd6647a8843eb977fdc91f89.jpg)